tax shield formula excel

FCF EBIT 1-Tc Depr. Calculate sales tax if you get tax-inclusive price.

Tax Shield Formula How To Calculate Tax Shield With Example

Tax shield Pre-tax Income adjd Tax rate Net Income Net Cash Flow PV of Net Income Discount rate Total NPV of Income Pre-tax Note.

. How to calculate NPV. Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate. 5 The fifth item is the PV of all the future tax shields from CCA assuming the equipment will last forever under the half-year rule.

In some regions the tax is included in the price. Tax Shield 10000 40 100 Tax Shield 4000. It is We have a positive sign in front of it since this is tax.

Double counting of Tax shield and free cash flow. Do the calculation of Tax Shield enjoyed by the company. Based on the given information the WACC is 376 which is comfortably lower than the investment return of 55.

CF CI CO CI CO D t. Multiply your tax rate by the deductible expense to calculate the size of your tax shield. Case 1 Taxable Income with Depreciation Expense TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses x tax rate or EBT x tax rate.

This is usually the deduction multiplied by the tax rate. In the line for the initial cost. The tax shield formula is simple.

Sum of Tax Deductible Expenses 10000. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Depreciation Tax Shield 10000 40 100 Depreciation Tax Shield 4000.

Calculate the present value PV of each interest tax shield amount by. WACC 0583 45 0417 40 1 -32 WACC 376. In the condition you can figure out the sales tax as follows.

The intuition here is that the company has an. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. Select the cell you will place the.

How to calculate tax shield due to depreciation. Multiply the interest expense by the tax rate assumptions to calculate the tax shield. Tax shield formula how to calculate with example step by calculation examples apv adjusted present value overview components steps definition explanation cash flow after.

In this video on Tax Shield we are going to learn what is tax shield. How to calculate the depreciation. Tax Shield Deduction x Tax Rate.

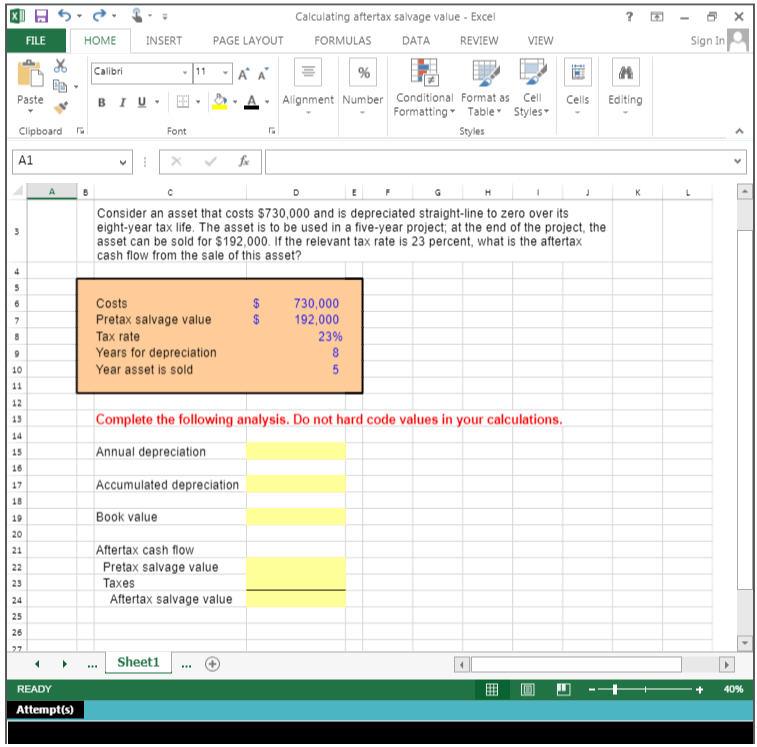

Interest Tax Shield Interest Expense Deduction x Effective Tax Rate Interest Tax Shield 4m x 21 840k. 1-046 24 1-046 25 of between 24 and. How to calculate after tax salvage valueCORRECTION.

Depreciation Tax Shield Depreciation expense Tax rate. CF CI CO D 1 t D. Tax Rate 40.

As such the shield is 8000000 x 10 x 35 280000. Where CF is the after-tax operating cash flow CI is the pre-tax cash inflow CO is pre-tax cash outflow t is the. Tax Rate and Tax Shield.

The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40. The effect of a tax shield can be determined using a formula. View our collection of valuation templates which incorporate the various valuation techniques and use them to create your own version of valuation models.

This is equivalent to the 800000 interest expense multiplied by 35. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. My understanding is that interest expense impacts the tax amount.

- Capex - WC. Based on the information do the calculation of the tax shield enjoyed by the company. PV of Tax Shield.

For example suppose you can.

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

Array Formulas And Functions In Excel Examples And Guidelines Excel Excel Templates Microsoft Excel

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Solved Calculating Aftertax Salvage Value Excel File Home Chegg Com

Download 10 Gst Invoice Templates In Excel Exceldatapro Invoice Format Invoice Format In Excel Invoice Template

Tax Shield Formula Step By Step Calculation With Examples

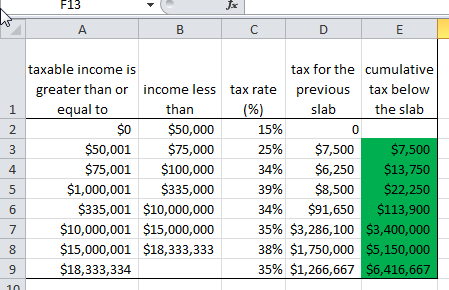

Solved Using Excel To Find The Marginal Tax Rate Can Be Accomplis Chegg Com

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Using Excel For Tax Calcs Jun 2019 Youtube

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator